“Sir, you invest Rs. 1 lakh per year for 10 years and after 20 years, you will get Rs. 20 lakhs guaranteed, tax free.”

Isn’t this going to get your mouth watering?

Well, the absolute number of Rs. 20 lakhs is quite a big number, that too guaranteed and tax free.

It is big enough to get you thinking and consider the investment. However, like a good investor, you would search for options.

What’s the alternative?

Let’s consider the Bank Fixed Deposit. A Bank FD is one of the safest investments with guaranteed returns.

If you invest the same Rs. 1 lakh every year for 10 years in a Bank Fixed Deposit at a 7 % rate of interest, what would you get?

The answer is Rs. 29.08 lakhs. But, the interest is taxable as per your tax bracket.

Assuming you are in the 30.9% tax bracket, your post tax interest rate would be 4.84%. The net amount you will receive is Rs. 20.99 lakhs.

Assuming you are in the 20.6% tax bracket, your post tax interest rate would be 5.56%. The net amount you will receive is Rs. 23.41 lakhs.

The XIRR of the Bank FD at the highest tax bracket of 30.9% turns out be to 5.17%.

In comparison, what is the rate of return on the tax-free, guaranteed returns investment option offered to you. If you calculate the XIRR, it turns out to be 4.83% over these 20 years.

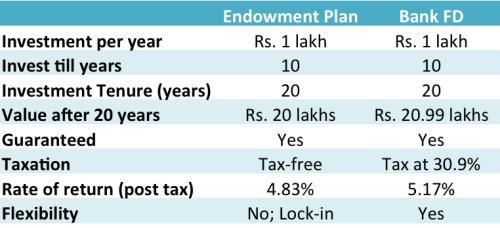

Here’s the comparison table.

Note: The base interest rate of the Bank FD is 7%.

As you can see, even with the benefits of tax-free, guaranteed returns, the investment offered to you falls behind the taxable Bank FD.

By the way, what is this investment product you are being offered?

It is a savings based insurance – an endowment policy. Insurance maturity receipts are tax free as per current tax rules.

Which guaranteed returns investment is better?

Is that still a question?

The Bank FD is more flexible as an investment. The endowment policy has a lock-in.

Interestingly, both the options guarantee one more thing. You will lose the purchasing power of your money. They are unlikely to beat the rate of inflation, the rate at which prices are rising.

Your investment portfolio is facing an acid test.

Thanks vipin for making things simple and educating people about typical endowment plans. One should read & know the investment plan do this kind of an analysis before investing.

Thanks Santanu. Investors need to ask questions.

I have fallen for these. But i have closed all from PNB to LIC. No more crap. Even though i had to pick up losses in those schemes but no more mistakes. One time loss is better than loosing again and again. Direct mutual funds and liquid funds is the way to go as i welcomed myself to the future of investing.

No more LICs, ULIPs, Bank FDs or PPF!!!

Way to go Gagan. All the best!