Query:

I was looking at a Monthly Income Plan (MIP) both conservative and aggressive as an alternative to FDs. Is that also a good option?

My goal is to distribute my Debt portfolio from Bank FDs. Debt funds are as good as FD but with TAX benefit.

I believe because of the small equity component ( 0% to 30%) in Aggresive MIPs they can offer a good return in debt portfolio with low risk which makes it better than Balanced Equity Funds and Debt Funds on either side of investments.

Hence I believe along with Bank FDs, Debt Mutual Funds a person should also diversify and invest in Aggressive MIPs as one of the debt instruments.

What is your thought on this?

– Investor

Here’s my response:

To begin with, let’s do an overview of a Monthly Income Plan or MIP.

An MIP is essentially an asset allocation product. It uses a combination of debt and equity for investments. The predominant investments are in debt, 70% to 95% typically, and the rest is in equity.

And that brings us to the variants of a Monthly Income Plan – Aggressive, Moderate, Conservative.

The aggressive variant has upto 30% in equity , Moderate 10 to 15% and the conservative (5 to 10%). The equity component is expected to result in higher returns than just a pure debt fund.

An asset allocation mix of debt and equity forces the fund to rebalance its equity and debt portion as per market conditions. If the equity portion tends to go higher than the acceptable ratio of say 30%, then the excess is sold and reinvested into debt and vice versa.

But not everything is good with an MIP.

First, it is one of those products which have a misleading name. MIP or Monthly Income Plan tends to suggest that it will offer you monthly income. Naive investors also tend to believe that it will offer assured income.

Nothing can be further from the truth. It’s a lie if you have been told so.

Second interesting thing about a Monthly Income Plan is that while it is called a Monthly Income Plan, you can opt for a quarterly dividend option, half yearly dividend option or even an annual option.

To top it all, you can decide not to have a dividend or income and let it accumulate in the growth option. This is so ironic.

Next, there is no guarantee of dividends or returns in MIPs. The name might make you feel that there is a guarantee, the fact is, there is none.

Some MIPs do give out consistent dividends, month on month, while others have a huge variation. If you are looking for fixed regular income via dividends, you might end up disappointed.

Anyways, that’s not the main point.

Let’s take up the original query of the investor.

Dear Investor, you want to invest in MIPs. And I understand why this shift. FD interest rates are going down and it is no more exciting. The MIPs at least offer you a better return with low risk, as you said.

I think you do not realise that you are essentially using a product with a built in asset allocation. A product that predominantly has investments in debt with an allocation to equity.

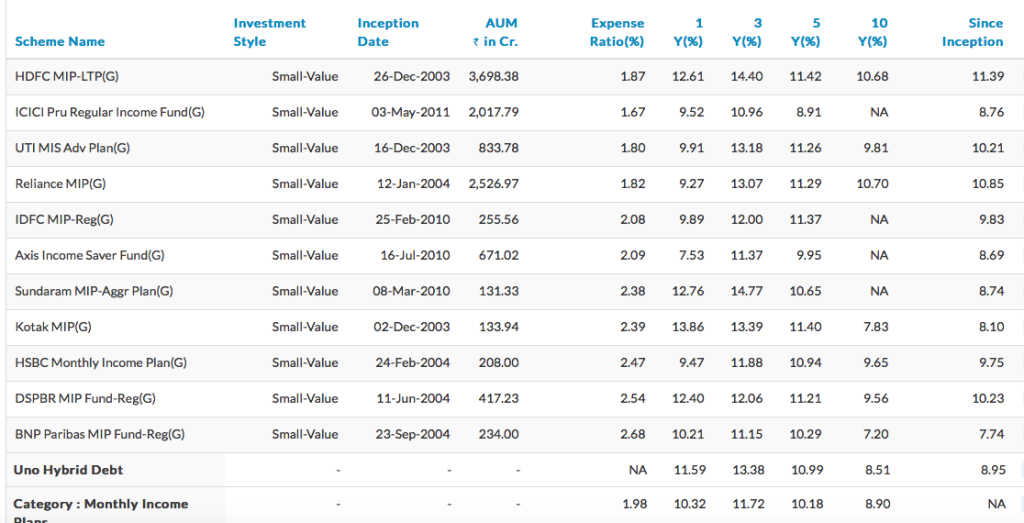

I pulled out a comparison chart of various Monthly Income Plans.

Source: Unovest. All regular plans. Data as on Nov 2, 2016. Uno Hybrid Debt is a custom benchmark used at Unovest for Hybrid Debt funds such as MIPs. It constitutes of 80% Debt (CCIL Bond Index) and 20% Equity (Nifty 500).

Monthly Income Plan is definitely more exciting in terms of returns compared to a Bank FD.

But please do not get swayed by past returns. The returns do not tell your how much dividend you receive. In fact, not of all this is given to you as a dividend. Some portion of it stays back in the fund and increases its value.

In general, if the interest rates are falling across the economy, the MIP returns are bound to fall too. You will get a weighted average return of the two asset classes in the future. So, if equity delivers say a 12% and debt 8%, then an MIP with 20% equity should give you 8.8% before taxes.

You also say that it is better than balanced funds or pure debt funds. Please understand each of the funds have a role to play in your investment plan. You select any of them based on the overall asset allocation and your preference for risk towards your goals.

Next, you mention that debt funds are as good as FDs.

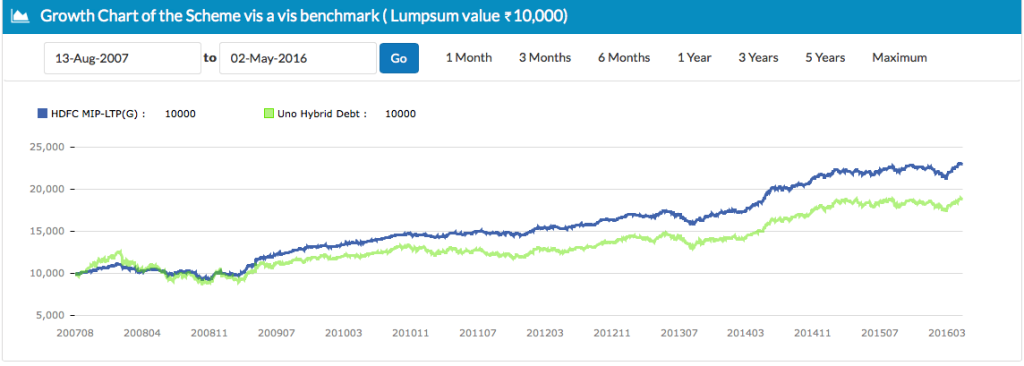

Let me share my own example. I had invested in an MIP in August 2007 and within a few months, the investment went below its original value. In fact, there were several periods when the value dropped from a previously attained value.

See the chart below.

It represents the period for which I was invested in the MIP. Mind you, it was an aggressive MIP.

Going by the ups and downs, anyone can mistake this for an equity fund’s chart. But that’s how MIPs are.

Finally, the taxation of a Monthly Income Plan.

An MIP is taxed like a debt fund. If you sell within 3 years, you pay tax on the gains as per your tax bracket, same as a Bank Fixed Deposit.

If you sell after 3 years, you pay 20% tax on the cost indexed gains.

Even if you are receiving dividends, they are only tax free in your hands, the fund still pays a dividend distribution tax on your behalf.

MIP is not a tax efficient asset allocation. You may rather have most of your investments in Fixed Deposits and invest the 10, 20 or 30% portion of your portfolio in an equity mutual fund. This gives you more tax efficiency, at least for now.

That’s what I have to say.

Please understand I am not trying to desist you from investing, only helping you see the relevant facts and take them into consideration before you make your decision.

Hope this helps.

All the best!

Disclaimer: Any names of mutual fund schemes that appear are purely for education and information. This post should not be considered as investment advice. I currently do not hold any of these funds.

Hi, very informative article.

Is peer to peer lending a viable option to invest?

Thanks Vikas. What would be your reasons to consider p2p lending?

Thanks for clarifying yet another thing I didn’t know. I knew that there are debt funds with a tiny equity component, and I knew there are MIPs, but I didn’t know they are the same. I also thought they are a (bad) way to generate a monthly income.

Your point about tax also holds, in the sense that if a fund has an equity component, it should be at least 65%. Otherwise, better to invest in a pure debt fund and a fund that’s classified as an equity fund, to increase flexibility. And minimise tax, as you pointed out.

Too many hybrid products are being positioned / sold as alternatives to FD. All OK as long as the grapgh is rising on the right!

Personally prefer to choose my Equity scheme even if allocation is 20%

Super! Thanks for the comment Mahesh.