(This report on Sundaram Select midcap fund originally appeared on the Unovest Blog.)

What’s the thing about midcaps?

Ask any seasoned investor and he would agree that the potential available with midcaps (as they grow and turn themselves bigger) could be huge. However, midcap stocks can be very volatile.

For those investors who would want the exposure to midcaps but not take the pain of looking at individual stocks, they can invest through midcap funds and make them a part of their long term portfolio.

Midcap funds would mimic the behaviour of midcap stocks as they ultimately invest in them. They can take you on a real topsy-turvy ride. Thus, it is important to select the right fund for your portfolio.

There are several midcap funds out there in the market. It sometimes becomes real difficult to pick one over the other.

Yes, performance is what you would look at but in my view one needs to go real deep – beyond just the performance numbers – and see which fund fits in his/her portfolio and financial goals.

We will make an attempt today with one of the funds.

In this report, we cover one of the oldest funds from the midcap space – Sundaram Select Midcap.

As mentioned, we will attempt to go beyond the performance and understand the fundamental nature of the fund and evaluate how well it has done with respect to its mandate – things that you should look at before making it a part of your portfolio.

Let’s get started.

Sundaram Select Midcap Fund – An Introduction

The fund started its journey in July 2002 with one of the prominent fund houses in the country, Sundaram Mutual Fund. That makes it a veteran with an experience of over 12 years.

You can relate to the fund house name if you have heard of the industrial group of TVS, named after prominent industrialist TV Sundaram, including companies like Sundaram Fasteners (an award winning quality supplier from India to GE).

Investment Objective

The investment objective states what the fund intends to do. As stated by the fund the objective is “to achieve capital appreciation by investing in diversified stocks that are generally termed as midcaps.”

Fund Benchmark

The fund will benchmark its performance with the S&P BSE Midcap Index. This index comprises of stocks that fall between 80% and 95% of the market capitalisation of the stocks listed on the Bombay Stock Exchange. This broadly represents the mid and small cap stocks space.

Fund Manager

The current fund manager of Sundaram Select Midcap fund is S Krishnakumar who is also the CIO of Sundaram MF since April 2015.

Krishnakumar has been with Sundaram MF since December 2003, has risen the ranks over the years. Managing the midcap fund since Nov 2012 after he took it over from Satish Ramanathan, the previous fund manager who managed the fund since 2007.

Along with Sundaram Select Midcap, Krishnakumar also manages Sundaram SMILE Fund, Sundaram Select Small Cap series and Sundaram Value Fund – Series I. He is also a co-manager of Select Microcap series, Tax Saver, Value Fund – Series II, Hybrid Fund – Series M &N.

He brings a lot of relevant experience, gathered over the years with small, mid and micro cap funds, to the Sundaram Select Midcap fund.

Asset Allocation – How does the fund propose to invest across assets?

Asset Allocation determines in which asset classes will the fund invest. Broadly, they are Equity, Bonds/Debt, Cash and others.

Sundaram Select Midcap has specified in its Scheme Information Document that its indicative asset allocation would be as follows:

| Instrument | % of investible funds | Risk Profile |

| Equity and Equity related instruments (including derivatives) | 75% to 100% | High |

| Cash, cash equivalents, money market instruments | Upto 25% | Low |

The Scheme may also invest up to 35% of the net assets in overseas securities.

As indicated, the fund will have minimum 75% of its portfolio invested in equities at all times. The fund also has the mandate to hold upto 25% of its money in cash and related instruments. This can allow the fund to wait for the right investment opportunites.

However, as we will see, the fund has almost always remained fully invested in equities.

Investment Strategy

As we now understand, the fund by nature is a pure mid-cap fund. In line with its mandate, the fund selects its stocks from a universe that starts from the 51st stock on NSE or National Stock Exchange by market cap.

What this means that they would not invest in the first 50 largest stocks listed on the NSE. This shall be determined based on market cap at the time of the investment.

Having said that, “the scheme portfolio will have a weighted average market-cap substantially lower than the permitted threshold.” This further indicates that more of the stocks will be picked from down the market cap ladder of mid caps and small caps.

The last reported weighted market cap of the scheme portfolio is Rs. 10,354 crores. The median market cap is at Rs. 7,263 crores.

The Scheme will own a diversified portfolio of stocks and focus on the liquidity aspect. Liquidity is an important criteria. Holding liquid stocks allows the fund manager to buy and sell based on investor flows in the fund.

Now let’s understand the investment strategy in practice.

Number of stocks and Turnover

The fund holds about 60 stocks in its portfolio (last reported in factsheet). For a midcap portfolio, that may not be a very large number.

The last reported turnover ratio of the fund is at 28% which means that, on an average, a stock spends about 3.5 years in the portfolio. That points to a buy and hold strategy of the fund.

Portfolio Strategy – Market cap allocation

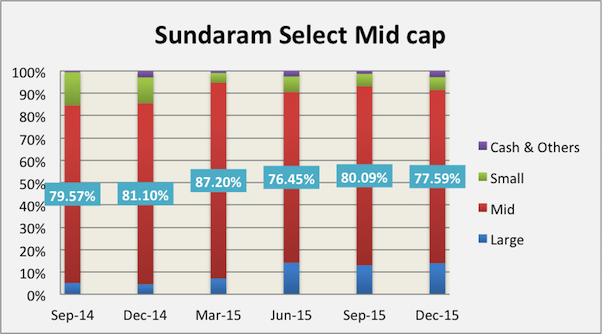

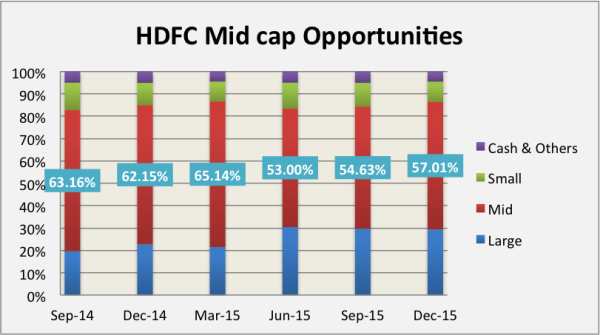

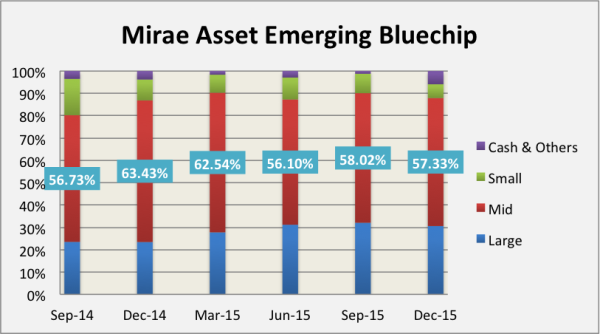

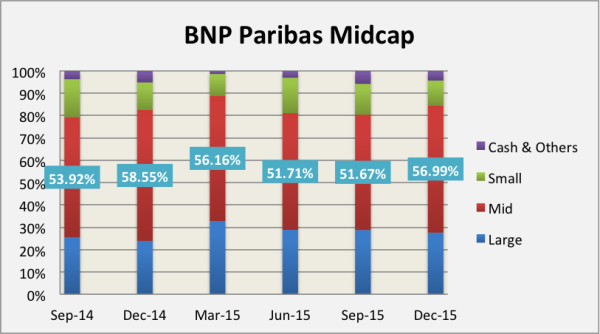

Here a few charts that indicate the Market cap Allocation over the past 6 quarters of Sundaram Select Midcap as also a comparison with 3 of its peers. The peers are

- HDFC Midcap Opportunities Fund,

- Mirae Asset Emerging Business Fund and

- BNP Paribas Midcap Fund.

Market cap allocation of Sundaram Select Midcap and its peers

Source: Unovest Research; Data as on Feb 25, 2016.

What do you observe?

While its peers have held large caps upto as much as 30% at various times, Sundaram Select Midcap has stayed true to its mandate of being a midcap fund.

Its large cap stock allocation – as per Unovest definition – in its December 2015 portfolio was 13.9%. This, by the way, still doesn’t include the top 50 stocks by market cap.

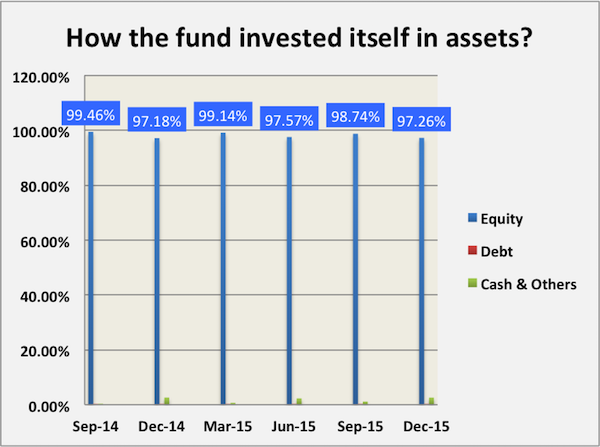

Asset Allocation – How did the fund invest itself across assets?

Let’s now look at how the fund has allocated the portfolio between equity, debt and cash over the past 6 quarters. As we noted earlier, the fund has the leeway to go upto 25% in cash.

As you can see, the fund has remained invested in the markets through equity holdings. Holding cash has rarely been used as a strategy.

I can hear the murmurs. “All this is fine. What is the performance of the fund? Tell us about that.”

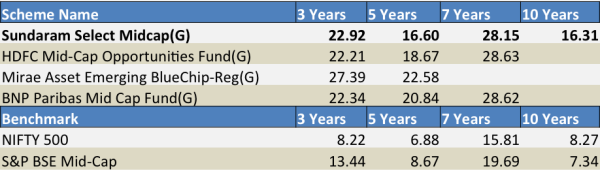

Fund Performance and Comparison with Peers

Performance is the holy grail for the investor. After all, you invest for performance and returns, whatever the strategy of the fund might be.

Let’s see how the fund has fared itself and in comparison with its peers.

Note: The returns are percentage annualised on a trailing basis. The date of the observations is Feb 25, 2016.

We are looking at the regular plans of these funds since performance data for direct plans is available for upto 3 years only for now.

The comparison also includes performance of two indices – one is the benchmark of the fund, that is, S&P BSE Mid cap and the other is the broad market index, Nifty 500.

The fund does not disappoint in its performance. It comfortably beats the benchmark.

If you are interested in some more rolling returns analysis of this fund, you can visit this post.

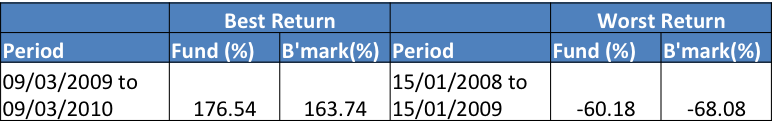

What’s the risk – how much can you lose?

In investing, risk is the chance that you will lose your original investment. Theoretically, you can lose everything in a wrong investment.

Let’s talk about the risk in this fund. Going by the above definition, what was the best and the worst performance of the fund in any 1 year period. Here it is.

If you look at the table, in any one year period, the maximum loss that the fund suffered was between Jan 2008 to Jan 2009. The extent of the loss was ~60%.

What this means is that that the fund value fell 60% in one year from Jan 2008 to Jan 2009. However, in the next 1 year or so, the fund recovered and added more by rising 176%.

That’s the kind of volatility you can face with equity funds and more so with mid cap funds.

Finally, the Verdict

Here are some of the key points on Sundaram Select Midcap fund:

- The fund has a track record of over 12 years.

- The fund tracks the midcap space with a diversified and growth approach.

- It owns stocks of companies that exhibit the ability to grow in a sustainable manner.

- It aims to generate capital appreciation by taking active sector, stock and cash calls with strict adherence to midcap mandate.

True to its nature, the fund can be very volatile in the short term, reflecting the market conditions. It isn’t for the faint hearted. Apart from general market risk, security risk, the lack of liquidity at times and higher volatility associated with mid caps stocks could affect the fund and its performance.

If you are evaluating this fund for your investment, you need to have a 10 year plus time horizon and oodles of patience.

Disclaimers:

- This report is not a recommendation to invest but to only enable you to understand the fund better – beyond the performance numbers.

- The information presented in this report has been collected from various sources including the fund fact sheet, scheme information document and the website of Sundaram Mutual Fund. Some analysis has been carried out with ACE MF, an MF analysis software.

- Mutual fund investments are subject to market risk. Please study the scheme related documents carefully before investing.

Hi Vipin,

Have come across your site today – nice informative post.

I am invested into diversified funds , but now am looking for a mid cap fund with a horizon of min 10 years. Can you please suggest any fund which doesn’t take huge risks, less volatile and has a good long term track record? is Franklin prima a decent one?

Thanks,

Dear Tridip,

Thank you for the kind words. In the mid cap category, the fund I like is the one you have read and commented on. It remains true to its mandate of investing in mid caps. the detailed analysis is in the article itself.

Having said that, I wouldn’t hold any grudge for Franklin Prima. https://smart.unovest.co/pages/scheme-details.aspx?schemecode=Jg55K+33iig=

Hope this helps.

Hi,

This is Ashok. Just now i have read your post. It is fantastic. Now i am reading all your posts. all are very nice.. keep going.

Dear Ashok, thanks for the feedback. Hope the articles are of use. Regards

Informative post !! Thanks for sharing this valuable information Mr Vipin Khandelwal !!

Thank you for reading Raj.